There are 2 tools available for paycheck modeling.

Tool #1: UNI Employee Self Service Payslip Modeling

Tool #2: Paycheck City Calculator

Both tools assist employees in determining changes in taxes and net pay when considering changes in withholding allowances, SRA, FSA, or insurance deductions, or earnings.

Tool #1: Payslip Modeling via UNI Employee Self Service:

1) Open a browser and go to the UNI home page: www.uni.edu.

2) Select MyUNIverse on the UNI home page by clicking on Menu drop down & then MyUNIverse.

![]()

3) Login to MyUNIverse

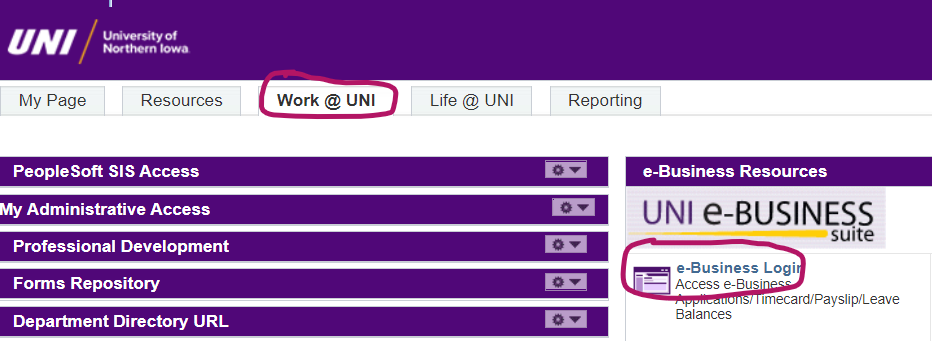

4) Login to UNI e-Business Suite located on the Work @ UNI tab in the e-Business Resources section.

5) Enter your e-Business username and password.

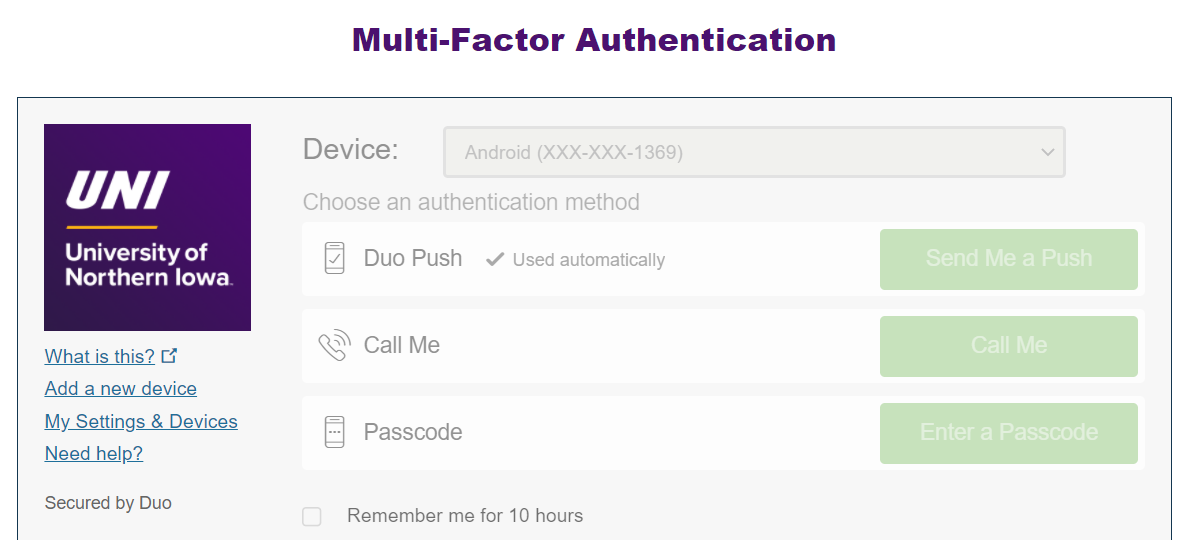

6) To access Payslip Modeling, you may have to enroll in Duo Authentication.

To enroll in Duo, please follow the prompts, or visit: https://mfa.uni.edu/enroll-our-account-duo for step-by-step instructions.

7) Select UNI Employee Self Service.

8) Click on Payslip Modeling.

9) Follow directions in Payslip Modeling.

Tool #2: Paycheck City calculator tool:

To determine what effect a change in W-4 allowances, pay, or deduction amounts will have on your net pay, visit the PaycheckCity website, an online collection of paycheck tools. You will use either the Salary Calculator or Hourly Calculator tool at the top. You will want to have a copy of your latest payslip earnings statement for reference.

Tips for using Paycheck City calculator:

- For Gross Pay enter your monthly income with Gross Pay Type of Pay Per Period

- If you have taxable noncash earnings on your payslip (e.g .Txbl Life Insurance, Txbl Vehicle, Txbl Meals) you should include them in the Gross Pay because they affect your taxes, but then you’ll need to subtract these noncash earnings amounts from the final net pay because these are not cash earnings paid to you.

- NT Tech Allowances are not taxable and should not be included in the Gross Pay amount to affect taxes. However after you Calculate and get your results you’ll want to add this item back into the net pay because it is a cash amount you receive.

- All deductions listed under Pre Tax Deductions on your payslip are exempt from federal, state, and FICA taxes except for TIAA, IPERS, and SRAs – these are exempt only from federal and state income taxes, not FICA.

- For efficiency when entering Deductions, you may want to consider combining similar type deductions, for example the After Tax Deductions from your payslip instead of entering each individually.

- Consider entering your TIAA or IPERS as a $ Fixed Amount instead of % of Gross Pay so it will not calculate a TIAA/IPERS deduction on noncash earnings such as Txbl Life Insurance. If you are doing a “What If” with new earnings you’ll need to use the % of Gross Pay for TIAA/IPERS if you’ll receive additional TIAA/IPERS on those earnings.

- If you choose to print results we recommend printing from the web browser. If instead you click on Print Options, you’ll then select Earnings Record Preview. You’ll then need to enter an ID, Employee Name, Address Lines 1 and 2, and Check Date fields and then click on Submit. These items don’t have to be actual information.