Trips |

- Trips must always be fully approved in workflow prior to incurring any expenses

- International trips should be requested at least 3 months in advance

- Anyone incurring reimbursable expenses should have their own “Individual” trip created in ProTrav

- Travelers are encouraged to use the most economical and appropriate means of travel

- Procards should be used for travel whenever possible

- Direct Travel Portal should be used for booking flights, hotels, and car rentals whenever possible, rather than online booking tools such as Orbitz, Expedia, etc.

- Short’s Travel Portal should ONLY be used for booking ALTHLETIC flights, hotels, and car rentals whenever possible, rather than online booking tools such as Orbitz, Expedia, etc.

Travel Expenses |

- Reimbursable expenses should be submitted within 120 days of travel on a Travel Expense Voucher (TEV)

- Itemized receipts are required for the following expenses:

- Airfare o Car Rental

- Hotel (showing $0 balance)

- Event Registration

- Bus/Train (when reservations required)

- Group Meals

- Any expense of $75 or more

- Event agendas required for all conferences, regardless of expenses being claimed

- Meals should be claimed at actual amount spent UP TO the maximum GSA allowance

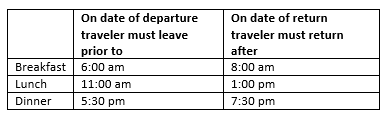

Time Frames to Qualify for Meal Reimbursements

- Transportation should be by most economical means available

- UNI Motor Pool preferred, when feasible

- Mileage – from home or UNI, whichever is less

- Use Google Maps for mileage calculations

- University Rate used when mileage is 100 miles or more

- Airfare should be purchased 2-3 weeks in advance

- Round-trip, coach-class fare

- Original ticket/receipt required

- Flight comparisons required when:

- Trip includes personal travel

- Non-designated airport is used

- Mileage exceeds $300

- Car rentals – please use contracted vendors, National or Enterprise, when available

- No additional insurance should be purchased when using contracted vendors

- Lodging is limited to standard single room rate plus taxes

- Conference rates or state/government rates should be requested, when possible

- Rooms may be shared with other employees, and the cost should be “split” onto each TEV

- Employees & students are not allowed to share rooms

- Miscellaneous Expenses

- Tips should not exceed 20% of the bill pre-tax subtotal

- Maid/baggage tips should not exceed $3-$5/day

- Travelers are allowed one checked bag each way

- Telephone/internet/data only allowed for University-related business – justification must be provided

Cash Advances |

- Only available to faculty & staff

- Travel that qualifies:

- Domestic travel exceeding 14 days

- International travel

- Team travel

- Student/other group travel

- Athletic recruitment

- Must be requested at least 2 weeks prior to travel

- Expenses must be substantiated within 2 weeks from trip return date; an advance over 120 days past due is reported as income to the IRS as taxable

International Travel |

- Travel registry is strongly encouraged

- Must follow international meal per diems, based on US Dept of State rates (excludes incidental portion)

- Expenses must be submitted in USD, with the exchange rate documented using OANDA.com or with a copy of the payment card statement

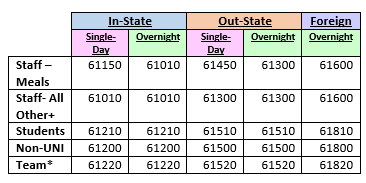

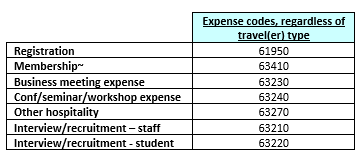

Object Codes |

Travel object codes are based on Travelers' end destination.

+When faculty or staff are traveling on behalf or for the benefit of students, and would not otherwise be traveling, the respective student object code should be used

*These codes are only used when travel is for competition purposes

Single-day meals are only taxable for faculty and staff

~Must have valid business purpose justification, such as required to attend conference, cost of membership plus member rate is less than non-member rate, or necessary for employee’s role with the University

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Additional Tips |

- Travel and lodging discount programs are allowed, but with the understanding by the traveler that any rebates and/or other concessions are the property of the University

- When an employee combines vacation with business travel, reimbursement for car rental, lodging, mileage, parking, meals, etc. will not be granted during personal days. Individuals not on University business may accompany, at their own expense.

- Persons other than faculty and staff traveling on university business are subject to the same guidelines as faculty and staff.

- When driving on University business, the traveler must have their driver’s license validated annually by Motor Pool – please call 273-2610 to provide your driver’s license number. If a personal vehicle is being used, a current auto insurance policy must be in place that covers the vehicle in operation.

- Any expenses paid on behalf of another employee should be “split” to their TEV within ProTrav.

- Certain expenses are disallowed and non-reimbursable:

- Personal or travel/trip insurance

- Airline seat selection fees, upgrades, or extended leg room accommodations

- Personal memberships

- Car rental upgrades, navigation systems, and other options

- Valet parking

- Hotel upgrades, safe rentals & laundry services

- Short-term airport parking when long-term available

- Entertainment, or other personal expenses

- Alcohol

*Please review the University travel guidelines for additional information.

| If you have any questions about travel, please contact Business Operations at 319-273-2162 or email protrav@uni.edu |