Tax Information

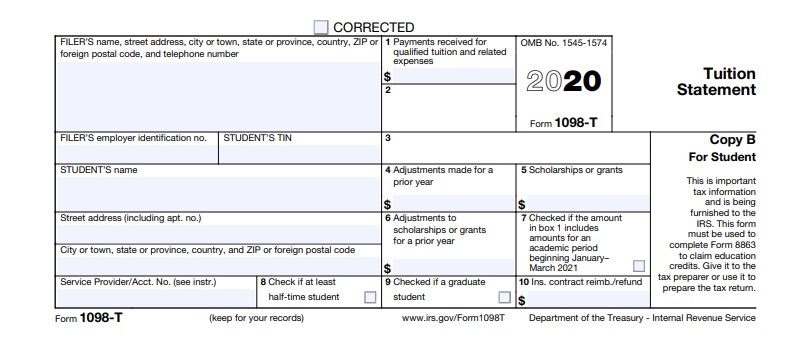

Every January the University of Northern Iowa provides the IRS a 1098-T tax form for all students who were enrolled during the previous tax year. The 1098-T form helps students and/or their families determine whether or not they are eligible to receive a tax credit for a given tax year. This form is available by January 31st each year. The form is available electronically through the student's MyUNIverse Student Center or through a Third Party Account with the appropriate permissions. Instructions for downloading the form are listed below.

For more information about tax benefits, please visit the IRS website: Tax Benefits for Education

Note: To withdraw your consent for electronic receipt of your 1098-T tax form, please email student.accounts@uni.edu and request your electronic consent be withdrawn.

Accessing your 1098-T:

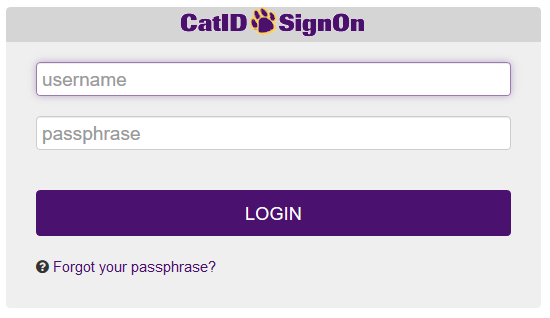

Step 1

Log into MyUNIverse with your UNI CatID Username and Passphrase.

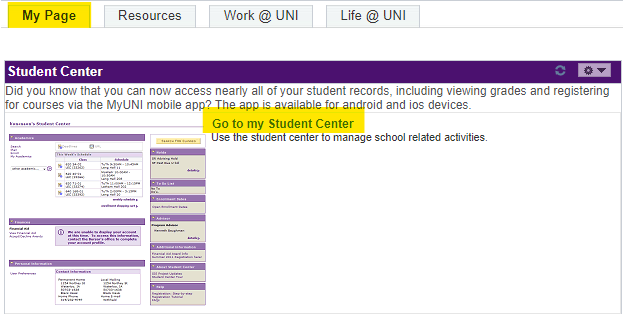

Step 2

Click the "Go to my Student Center" link on the "My Page" tab.

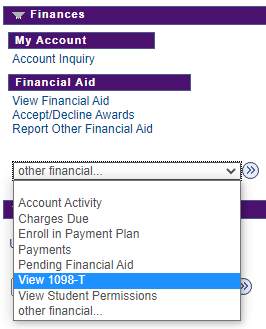

Step 3

In the Finances section, select "View 1098-T" from the "other financial..." drop-down menu.

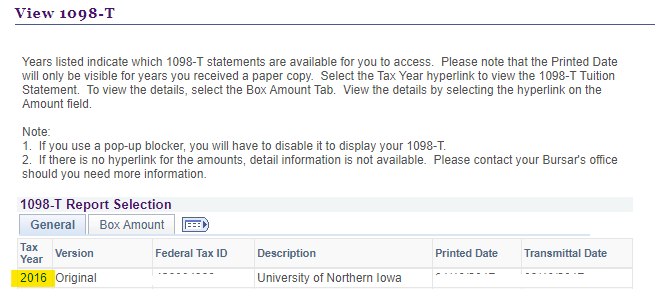

Step 4

On the 1098-T Tax Form tab, click the appropriate tax year.

NOTE: The form will open in a new tab. You may need to enable pop-ups for your browser to allow the form to open.

Step 5

Result : The 1098-T opens as a PDF and may be saved or printed.

If you have any questions about accessing your 1098-T Tax Form, please contact the Student Accounts team at student.accounts@uni.edu or by phone at 319-273-2164.